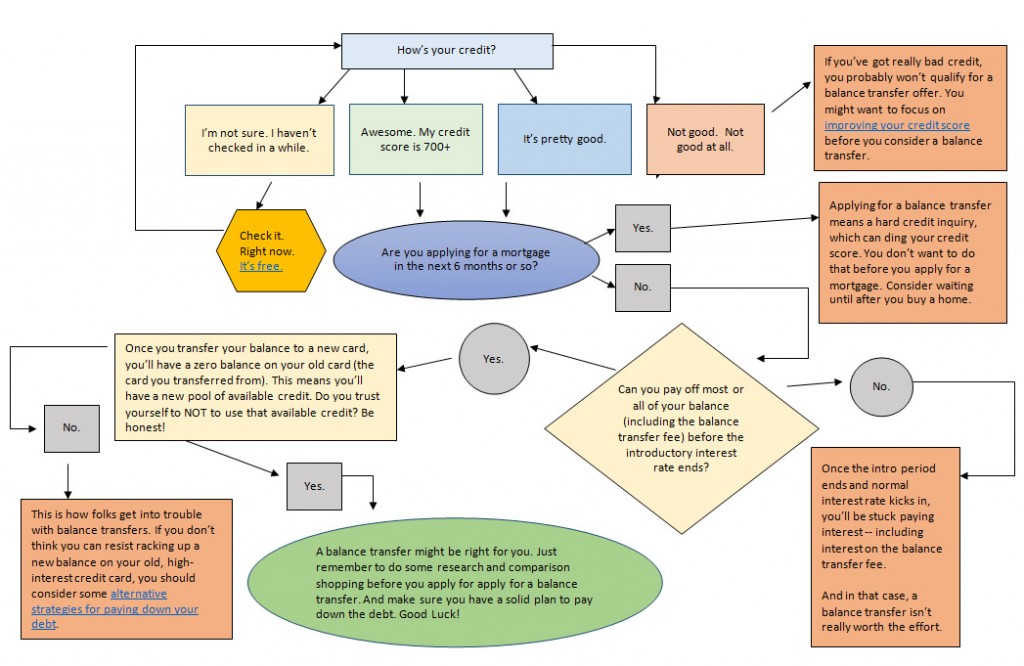

Are you wondering whether or not you should apply for a balance transfer? If you’re struggling to pay down high-interest credit card debt, a balance transfer can be a powerful tool. Balance transfers offer super-low (or even zero-percent) introductory interest rates, which means they help you pay your principal balance off more quickly. But that doesn’t mean that balance transfers are for everyone. Use this decision tree to figure out of a balance transfer is a good option for you.

CLICK IMAGE TO SEE LARGER VIEW

Plan Ahead for the End of the Introductory Period

One of the most critical aspects of a balance transfer is knowing when your promotional APR ends. Many cards offer 0% rates for 6–21 months—and once that window closes, any remaining balance typically reverts to a much higher variable rate. You’ll want to use that introductory period strategically—divide your total transferred balance by the number of months in the offer to calculate the minimum monthly payment needed, and then consider paying 10–15% extra to build in a buffer and ensure you’re truly on track to get it paid off prior to the expiration. If you’re unable to consistently pay that amount, the savings you thought you were gaining could quickly evaporate.

Avoid Common Pitfalls That Can Void the Deal

The best balance transfer deals only work if you avoid specific triggers. For instance, late or missed payments can cancel your promotional rate immediately, resulting in a sharp jump to penalty APRs that far exceed your previous rate. Additionally, making new purchases on the same card may eliminate the grace period—interest can start accruing on new charges immediately at the non‑promotional rate. Finally, applying for too many cards at once can lead to multiple hard inquiries, which can temporarily ding your credit score—and closing old cards after transferring the balance can shrink your credit history and raise your utilization ratio, so consider keeping accounts open but unused.

If you are contemplating a balance transfer and need some additional guidance, feel free to reach out to our trained counselors for a free credit counseling consultation.