Ah the wonders of the 50/30/20 budget… As someone who makes a living by helping people untangle their sometimes (very) messy financial lives, I can tell you that I know what gets folks in hot water, financially speaking. Sure, it’s easy to just chalk it all up to irresponsibility. But it’s not always that simple. Most of the people I work with are trying to change their financial situations: They’ve read the books, they’ve gathered their monthly bills and made a budget that – on paper, anyway – seemed livable. They have good intentions.

But they still come up short every month. They don’t have savings. They certainly don’t have that $500 emergency fund the experts say we’re all supposed to have. Despite their best efforts, they’re still living paycheck-to-paycheck.

What gives?

Well, here’s the thing: A budget is a little like a diet. It takes discipline and it’s not always easy. Too many restrictions, and it feels more like a punishment than a healthy life change. Bend the rules too much, and you’re right back to where you started.

The best kind of budget is all about moderation. It allows you to pay your “must-have” living expenses, put some money in the bank (or use it to pay down your credit card debt) – and it allows you to have some left over for the fun stuff – a vacation; a fancy dinner every now and then.

That’s what I like about the 50/30/20 budget. Not only does it help you live within your means; it also helps you figure out exactly what your “means” are. The budget is touted by financial experts like MSN Money’s Liz Pulliam Weston, and for good reason: it works.

Needs/Wants/Savings

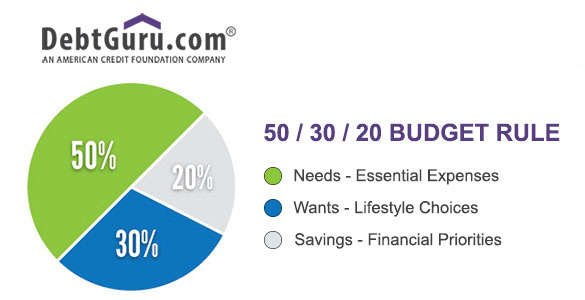

Think of your total monthly income as a pie:

With the 50/30/20 budget, you’re basically just cutting your monthly household income into three pieces. To get started, simply add up your total monthly household income, including:

- Your income (after taxes)

- Your spouse or partner’s income (after taxes)

- Any other sources of income, like child support

The biggest piece – the 50% piece – goes toward all of your basic necessities. This is the must-have stuff, including:

|

|

The 30% piece goes toward all the extras – “wants” that are nice, but not essential:

|

|

The 20% that’s left over goes to you in your savings account or your emergency fund (you can also use it to make an extra payment on a credit card or student loan).

A Balancing Act

What’s your 50/30/20 budget? Use this simple worksheet to find out.

| Your total monthly income, after taxes and deductions: | Amount you should spend on must-haves(monthly income x .50): | Amount you should spend on wants(monthly income x .30): | Amount you should use toward savings/debt (monthly income x .20): |

| $ | $ | $ | $ |

Another nice thing about this budget is, it’s a good goal-setting tool. You may find that you’re spending, say, 70% of your monthly income on “must-haves.” Or you may realize that almost 50% of your monthly income is going toward things you don’t really need.

The 50/30/20 budget is a good way to get a feel for where your money is going . . . and a good opportunity to make some adjustments.

If you’re spending more than 50% of your monthly budget on “must-haves,” look for ways to cut costs: trim down your grocery bill, turn off lights and go easy on the air conditioning to save electricity, or consider dropping your land line if you’ve got a reliable cell phone.

If you’re blowing more than 30% of your money on “wants,” it’s time to start prioritizing: If you can’t live without your super-deluxe, high-def digital cable, you might need to say sayonara to your once-a-week sushi splurge. Pick a few favorites and stick to them.

That’s one of the greatest things about the 50/30/20 budget: It’s customizable and nothing is off-limits (as long as it’s within your budget). It’s a lot like a good diet plan: It’s sensible, it’s sustainable, and it lets you “cheat” a little.

Ready To Become Debt Free? Let us use our years of experience to show you simple tactics to pay off debt, build your financial safety cushion and make solid decisions when it comes to your credit and finances. Our consultations are always private, professional and FREE! Contact the DebtGuru team today