In today’s world of e-commerce, digital payments and stored passwords, identity theft is an ugly, sometimes life-altering reality. Data breaches threaten to leak our most personal financial information and sophisticated skimmers and hackers are hard at work trying to break into our credit cards, bank accounts, and more.

Luckily, there are several tell-tale signs that your identity might have been stolen if you take the time to pay attention. Be sure to read through the list below if you suspect criminals have compromised your identity and are using it to their own advantage, leaving you to foot the bill.

- Unfamiliar purchases appear on your credit cards or bank statements. This is why it’s critical to read your credit card statement. And don’t wait for your monthly statement; instead, create or log into your online account at least once a week if not daily to monitor charges and speak up if you see something you don’t recognize.

- Collection calls for debt that doesn’t belong to you. No one looks forward to calls from bill collectors, but if you find they’re badgering you to repay money you didn’t borrow it’s time to dig into your credit report and assess your overall debt to make sure it’s all yours and not someone masquerading as you.

- Small test purchases show up on your bank or credit card statements. In the hope you won’t notice, a thief may buy something with a small price tag before they use your account numbers for more substantial purchases. Again, this is when paying close attention to your statements is a good idea.

- Your electronic tax return is rejected. With April 15 fast approaching and many of us working on our yearly returns, this tip is timely. If a thief has stolen your social security number and used it to file a bogus tax return in your name, your own return will be rejected if you file afterwards.

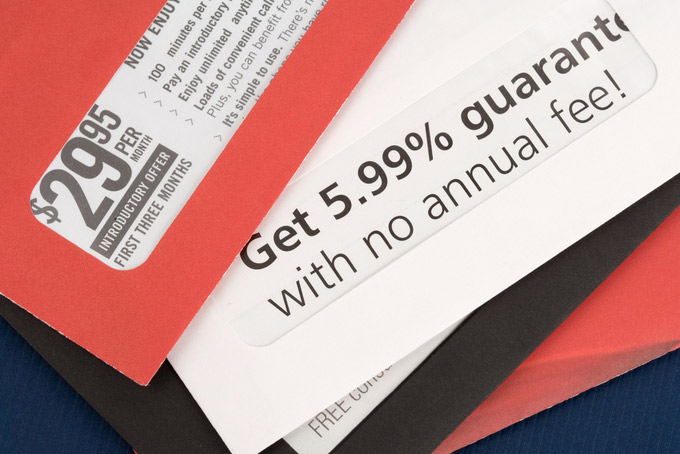

- You receive unsolicited credit cards. Identity thieves often use their stolen spoils to open credit cards in their victims’ names and hit the malls before the account is closed. If this happens to you, call the credit card company immediately, close the account and file a fraud report. Most will work with you and not hold you liable for the charges.

- Mistakes on your credit report. The government mandates we each have the right to one free credit report per year from either Experian, Equifax or TransUnion. Take advantage of this service and scour your report for anything unfamiliar or suspicious and, if found, report it immediately. Check out annualcreditreport.com.

- You begin receiving phone solicitation or direct mailers advertising big-ticket items. This can happen when a crook has used your name to purchase pricey items. Best to pay attention and not discard such notices as simply junk mail.

- Your employer alerts you to a security issue. A common trick for hackers is to steal your Social Security number and name of business where you work to collect unemployment benefits using your name. If your company finds out, they will alert you to the problem and it’s up to you to follow up.

- Retailers and other businesses won’t accept your check. If your checks are being rejected and you don’t know why, this may be a sign that someone other than you is clearing out your bank accounts.

Identity theft can indeed wreak financial havoc in your life and be emotionally jarring. Any suspected or confirmed incidents should be reported to the police, but it’s up to you to call any and all impacted creditors to alert them to the fraud and to rectify the situation, including removing bogus charges from your accounts or to close any unauthorized lines of credit. If you additional assistance with managing your credit, the team at DebtGuru.com is on hand to help.